The AIF addresses the same group of investors, i.e.The AIF is subject to comparable special State supervision.According to the corresponding explanatory memorandum, which has found its way into the UStAE, comparability requires in particular the fulfilment of the following conditions: It was then extended to AIFs (alternative investment funds) comparable to UCITS in 2018 due to the ruling of the European Court of Justice (ECJ) of 9 December 2015, C595/13, (Fiscale Eenheid X). The background is that the tax exemption was originally granted for the management of UCITS (undertakings for collective investment in transferable securities). Doubts already arose in this respect during the legislative process. However, the question arises as to whether the exemption from VAT is in conformity with European law. While this should often be the case, it does not necessarily have to be.Ĭoncretisation of the VAT exemption welcome, but: unlawfulness under European law?Īs an interim result, it can be stated that despite some ambiguities, the prerequisites for the VAT exemption would in principle be relatively easy to fulfil and it could therefore apply not only in theory, but also in practice.

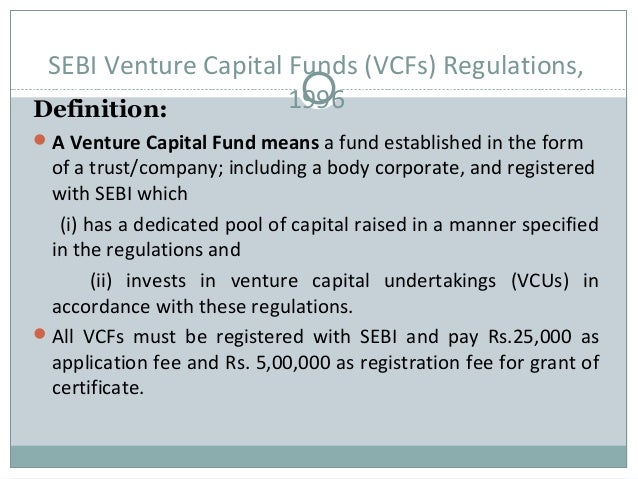

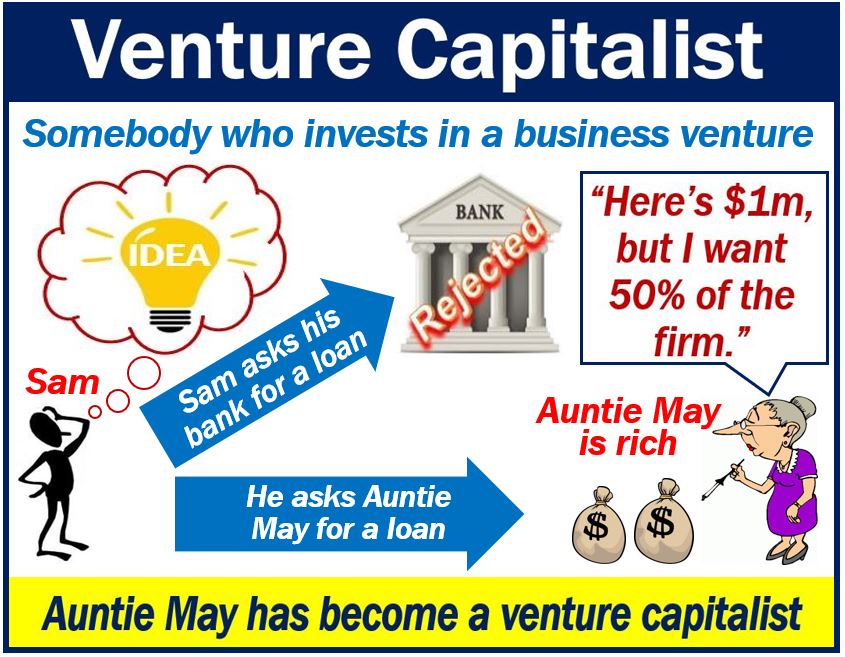

It is worth noting that a “qualifying venture capital fund” or EuVECA Fund does not automatically qualify as a venture capital fund but must also meet the above requirements. Since this is not specified in more detail, we do not consider it to be a separate requirement. It is unclear whether it is an (additional) requirement that the target enterprises are “innovative” and if so, when this is the case. However, an unambiguous formulation or clarification would be desirable. Since the “time of the first venture capital investment” is partially set out as a prerequisite, we understand that subsequent investments in target enterprises do not threaten the eligibility for the VAT exemption, even if the respective requirements are no longer met at the time of the subsequent investment. the German Financial Supervisory Authority – Bundesanstalt für Finanzdienstleistungsaufsicht ( BaFin)) or is registered as a “qualifying venture capital fund” within the meaning of Regulation (EU) No 345/2013 (European Venture Capital – EuVECA – Fund).

However, the amendment lacked a legal definition, which meant that it was previously unclear which funds were covered.Īt the beginning of March, the Federal Ministry of Finance ( Bundesministerium für Finanzen (BMF)) has published a draft letter on the adjustment of the Value-added Tax Application Decree ( Umsatzsteueranwendungserlass – UStAE). h) of the German VAT Act ( Umsatzsteuergesetz – UStG) to the management of “venture capital funds”. In July 2021, the Fund Jurisdiction Act ( Fondsstandortgesetz) extended the VAT exemption in section 4 No.

0 kommentar(er)

0 kommentar(er)